Every April, after the fiscal New Year begins, India’s passenger vehicle (car) sales often slip relative to the preceding months. Historical data shows that March (the last month of India’s April–March financial year) typically registers peak sales, followed by a slowdown in April as new budgets and seasons kick in. For example, SIAM reports that PV sales in March 2025 were 381,358 units, which fell to 348,847 in April 2025(a 8.6% drop). A similar drop occurred in April 2024 (368,086 to 335,629, down ~9%) and April 2022 (279,501 to 251,581, –10%). By contrast, April 2023 bucked the trend (up from 292k to 331k, a +13% rise) due to unique factors that year (see below). Overall, though there are year-to-year variations, the recurring pattern is that April sales dip compared to March.

To illustrate, consider passenger vehicle retail figures over recent years:

| Year | March Sales (PV) | April Sales (PV) | % Change (Apr vs Mar) |

|---|---|---|---|

| 2022 | 279,501 | 251,581 | –10.0% |

| 2023 | 292,030 | 331,278 | +13.5% |

| 2024 | 368,086 | 335,629 | –8.8% |

| 2025 | 381,358 | 348,847 | –8.6% |

These figures (from official SIAM data) underscore the general April slump. In words, April 2022 and 2024 saw double‐digit drops; April 2025 fell similarly. Only April 2023 was higher (likely due to the one‐off transition to new emission norms that year).

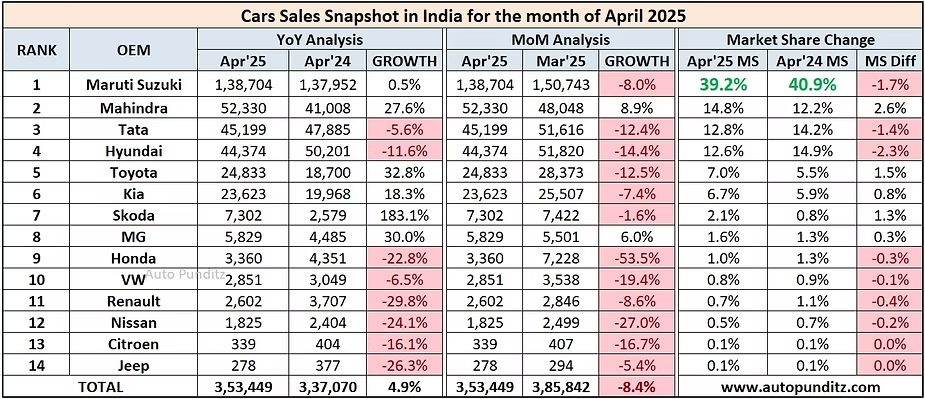

Source: autopunditz.com

Several key factors contribute to this annual dip:

- Fiscal year-end effects. March is the last month of India’s financial year, so companies and buyers rush purchases to meet annual budgets or claim tax benefits. Dealers and manufacturers offer big year-end discounts and sales incentives in March, pulling forward demand. A sales analysis notes that April “is usually a dull month… impacted with heavy wholesales in April due to financial year end” – meaning strong March shipments carry over to April. After March’s surge, April sales naturally settle lower. Businesses also often buy vehicles by March to maximize depreciation and budget utilization, so April sees fewer such orders.

- Government budget and tax planning. The Union Budget is announced each February, prompting consumers and firms to time purchases. Many wait for budget clarity on tax rates, rebates, or incentives before buying cars. Conversely, if potential tax increases or policy changes are expected post-April, buyers hurry purchases in March. Thus March can spike while April softens as the market digests the new fiscal-year rules. (For example, April 2023 had a special boost due to transition to BS-6 Phase 2 norms; that transition pushed some purchases into April instead of March.)

- Seasonality and festivals. April has fewer major nationwide festivals or sales events compared to other months. In India, car buying surges during Diwali (Oct-Nov), Christmas, and many regional festivals, but April has only minor holidays (like Baisakhi, Vishu, Chaitra Navratri) which give limited lift. FADA notes that buyers “leveraged Chaitra Navratri, Akshay Tritiya, Bengali New Year, Baisakhi and Vishu to complete purchases” in April 2025, but overall these are not as pan-India or buying-heavy as year-end festivals. Without big festivals, buyer enthusiasm is more muted. Also, April starts the hot summer and end of the school year – people travel or budget on families’ holiday planning, suppressing discretionary spends like new cars.

- Consumer and rural factors. Spring/August is wedding season but most big Indian weddings happen in Nov-Mar, so fewer March/April wedding-car buys. In rural areas, farmers may wait for the Rabi harvest (Apr-May) or be distracted by sowing, rather than buying new vehicles. On the other hand, a good Rabi harvest can boost rural demand, but much of that tends to materialize in May-June (after crop sales). In early fiscal year, some farmers might wait for crop sales proceeds. The net result is cautious consumer sentiment in April, especially among budget-conscious buyers, as noted by dealers.

- Dealer and manufacturer strategies. Automakers typically “load up” production and incentives in Q4 (Jan–Mar) to hit yearly targets, then reset in Q1. Dealers often enter April with bloated inventory from March sales. FADA reports high dealer stocks (~50 days of PV inventory) in April 2025. To clear stock, manufacturers offer heavy discounts in March, then pull back in April. Also, April is a common time for new model launch preparation or retooling, temporarily slowing sales of older models. In short, March has end-of-year push (discounts, target surges, fleet buys) while April sees an adjustment. For example, FADA’s April 2025 report notes the PV market was “discount-led… with elevated inventories” and entry-level buyers cautious.

- Segment trends. The April slump is not uniform across all segments. Consistently, utility vehicles (SUVs/MPVs) hold up better, while hatchbacks and sedans suffer more. As one analysis points out, SUVs now command roughly 65% of PV sales (Apr–Dec 2024) vs. only 31% for hatchbacks/sedans. April’s buyers have tended to favor higher-end SUVs (driven by rural and urban demand) while leaving budget hatchbacks on the sidelines. FADA and analysts note that “sustained SUV demand underpinned [April] volumes even as entry-level customers remained cautious”. In short, April weakness is especially acute for smaller cars, whereas SUVs and premium models see relatively steadier demand.

In summary, April’s sales dip reflects a mix of fiscal, seasonal, and market factors. Dealers and manufacturers push sales late in the year (March) through discounts and incentive schemes, leaving April comparatively quieter. April also lacks big festive tailwinds, and new fiscal-year policies reset buyer and dealer mindsets. Combined with cautious consumers and overstocked dealers, this routinely produces a MoM drop in April.

Key Takeaways:

- Year-end pull: Many buyers and fleets rush purchases in March (for tax/fiscal reasons), then pause in April.

- Policy timing: Budget announcements and tax-year switches shape buying cycles, often delaying some purchases into the new FY or hastening them in March.

- Festive timing: With no major nationwide festivals in April, demand is naturally lower than in festive months.

- Market adjustments: Dealers/automakers clear stock in March, start new models and pricing in April, which can momentarily damp sales.

- Segment shifts: SUVs carry April sales, but small cars/sedans (which are more price-sensitive) tend to see larger drops.

Why April Specifically?

Putting these pieces together: April is India’s fiscal-year reset. After a peak in March, both buyers and companies take stock. Consumers may delay a purchase until new budgets or until the previous year’s promotions expire. Dealers, flush with March volume, often cut back on April price cuts. The combination of “no festivals, high March activity, and waiting for new fiscal rules” makes April a transitional month with subdued sales. As one auto analyst observes, April is “usually a dull month” precisely because the financial year- and festival-driven demand has just passed.

Impact of Government and Economy

Government policies amplify this cycle. The Union Budget (February) and tax-year changes (April) incentivize end-of-year buying. For example, if budget incentives for auto buyers or loan rates change, purchases accelerate before April. Conversely, if new tariffs or taxes kick in from April 1, buyers rush in March. In April itself, uncertainty often prevails: dealers await clarity on policies, and buyers digest changes in lending rates or incentives. In 2023 this dynamic was pronounced: April 2023 saw unusually high sales (a 12.9% year-on-year jump) because buyers and dealers scrambled to meet new BS-VI Phase 2 emission norms effective April 1. Absent such one-offs, April typically slows.

Macro factors also play a role. If interest rates or inflation change at fiscal year-end, credit costs for car loans may rise in April, dampening demand. Conversely, any rate cuts or liquidity infusion by the RBI around mid-year may eventually boost sales, but with a lag. For now, the broader economy’s seasonal patterns (harvest-linked rural income, the wedding season winding down) tend to favor the March quarter.

Dealer and Manufacturer Strategies

Automakers and dealers are acutely aware of the April lull and plan accordingly. They clear old-model inventory by March-end and introduce new models or variants shortly after. End-of-year clearances (cash discounts, fleet offers) make March attractive, then April returns to “normal” pricing. In April 2025, for instance, FADA reported PV inventories of about 50 days of sales – meaning dealers still had many unsold cars from March, reducing the need for fresh April buys. Manufacturers may also throttle production slightly in April to avoid excess stock. These industry tactics further widen the March–April sales gap.

Consumer Behavior

Buyer psychology reinforces April’s softness. With many purchases (festive gifts, holiday expenses) already made earlier in the year, April buyers are more cautious. Entry-level buyers in particular “remain cautious” on budgets, waiting to see if interest rates fall or if new models are worth waiting for. In rural India, some of the April uptick may come from post-harvest spending, but again much of that comes a bit later in the quarter (May–June). Urban middle-class consumers, meanwhile, have just seen year-end bonuses and tax filing – they may choose to delay a big spend until they’ve secured fiscal-year finances. All these behaviors translate into lighter showroom traffic in April.

Segment Breakdown

The April trend also interacts with which cars people buy. SUVs and premium cars often see more stable sales, whereas demand for hatchbacks/sedans is highly cyclical. As noted, SUVs took ~65% of PV sales in 2024, leaving the remaining 31% to smaller cars. In practice, April’s buyers tend to be the more affluent ones who go for SUVs (still robust) and whoever needs a car urgently. Budget-conscious buyers of small hatchbacks often postpone to see if prices fall or wait for next year’s budgets. Indeed, April 2025 retail data show SUV/MUV segment sales edging up slightly MoM, while compact cars saw larger declines. This segmentation means the April dip may be more visible for some brands/models (e.g. Maruti’s Alto/Celerio or entry sedans) and less for others (e.g. Mahindra/Kia SUVs).

Outlook and Takeaways

Will this April dip persist? All indications are yes, unless major structural changes intervene. The financial-year calendar is unlikely to change, and cultural buying patterns have been entrenched for years. Automakers and dealers expect April/May to stay “steady but muted” as they manage inventory and await new launches. Economic trends also suggest a cautious short-term outlook: dealers report neutral-to-cautious sentiment, with expectations of flat or modest growth into the mid-year.

Actionable insights: For consumers, this means that March often brings the best deals and widest discounts, whereas April prices may be higher and choice more limited (pending new launches). Those not in a hurry might use April’s lesser demand to negotiate (dealers eager to clear showroom stock may still offer deals). Dealers should anticipate lower footfall and plan promotions in April to smooth the transition. Manufacturers may time new model rollouts in Q1 to reinvigorate interest. Policymakers could also note this cycle: for example, any incentive or tax change effective April can either mitigate or exacerbate the April slump.

In summary, the April sales dip is a recurring blend of year-end buying spikes and a natural post-holiday lull. FADA analysts suggest the industry should continue “disciplined inventory management, targeted incentives and easing borrowing costs” to navigate April softness. Unless government policies or market structures shift dramatically, India’s car sales will likely keep climbing into March and easing off in April in the foreseeable future.

FAQ’s

2. Is the April sales drop a sign of declining auto demand?

Not necessarily. The April dip is often temporary and driven by cyclical trends. Sales usually pick up again in the following months with new launches and festive offers.

3. When do car sales typically pick up after April?

Sales usually start to rise again from June–July onwards, peaking during the festive season between September and December.

Disclaimer: The information presented in this article has been gathered from multiple publicly available and industry-related sources. It is intended for general informational purposes only. While every effort has been made to ensure accuracy and reliability, there may be minor discrepancies or changes over time. We encourage readers to independently verify before making any decisions or taking action.